The State of DAO M&A

M&A could be critical for building resilient and scalable decentralized organizations. But, after 65 deals and counting, we’re not there yet.

Mergers and acquisitions (M&A) are a well-established mechanism for growth and consolidation in traditional markets. DAOs, by contrast, are a nascent organisational form - internet-native, community-governed entities operated via blockchain smart contracts and token-based voting.

This article focuses on an emerging and exciting frontier in M&A: DAO M&A, a novel phenomenon where a DAO merges with, acquires, or is acquired by another entity - whether another DAO or a traditional company - in order to form a combined entity under shared governance. Since 2020, we have seen at least 65 M&A deals involving DAOs, at an average deal valuation of around $30 million.

Unlike traditional industries with well-defined assets and legal frameworks, DAOs are fundamentally digital, community-owned, and governed by token-holders; all structures that complicate the core elements of M&A. While they retain the basic motives for M&A, DAOs must navigate new challenges in their pursuit of acquired value:

Novel Mechanisms: DAO M&A transactions often involve tokens, a relatively new asset class with compliance implications that vary around the world.

Valuation: Tokens fluctuate significantly, and traditional valuation metrics don’t always apply or are difficult to defensibly quantify (i.e. multiples-based, DCF).

Regulatory Uncertainty: Varying jurisdictions and the lack of clear DAO-specific regulations add complexity.

Governance Frictions: Ensuring alignment among diverse, globally distributed stakeholders is difficult, and hostile takeovers can emerge (e.g., Gnosis' acquisition of xDAI).

DAO M&A Activity

Most M&A activity in the Web3 space has not involved DAOs, despite the substantial size of DAO treasuries and meaningful value creation occurring especially for DeFi DAOs.

From left to right on the timeline (2018Q1 through 2025Q1), the chart shows two stacked bars per quarter. First, bright blue bars for all Web3 M&A activity (i.e., total mergers and acquisitions in the broader crypto/web3 space), and second, black bars specifically for DAO-related M&A deals. Overall, Web3 M&A deal counts remain relatively modest until late 2020, then pick up sharply through 2021 and 2022—mirroring the sector’s bull-market phases. After a dip aligning with the “crypto winter” period, another wave of growth emerges in 2023/2024, culminating in elevated deal counts by 2025Q1. Throughout these ups and downs, DAO-focused deals (the dark blue portion) consistently lag behind the total Web3 M&A volume but rise and fall in tandem with the broader market cycle, indicating that DAO transactions represent a niche but growing segment within the larger Web3 M&A sector. In total, we observe 65 deals that involve a DAO and 898 that do not.

We observe some differences in motivation for Web3 vs. DAO M&A activity. The figure below compares the listed motivations from the news article, average disclosed deal sizes, and total observations for general Web3 M&A activity (Column 1) vs. DAO-specific M&A deals (Column 2), along with the percentage point differences (Column 3).

Both Web3 and DAO deals cite “accessing new verticals” most often (77% and 72%, respectively), while citing traditional synergy gains remains relatively low at 16% each. By contrast, DAO transactions emphasise acquiring talent or a specific asset (e.g., an operating license) more strongly (49%) than Web3 deals (39%) - an 11% gap, which is statistically significant. Lesser-cited motives in both groups include consolidating power, speed to market, and geographical expansion, though each of these factors appears at slightly higher rates in Web3 than in DAO deals. Taken together, these results suggest that regulatory uncertainty and valuation challenges in the DAO ecosystem are so pronounced that, to date, M&A activity has largely been confined to acquiring specific assets or talent rather than entire organisations. Consistent with this view, the typical DAO M&A deal is much smaller in total value (around $30 million) than Web3’s $705 million.

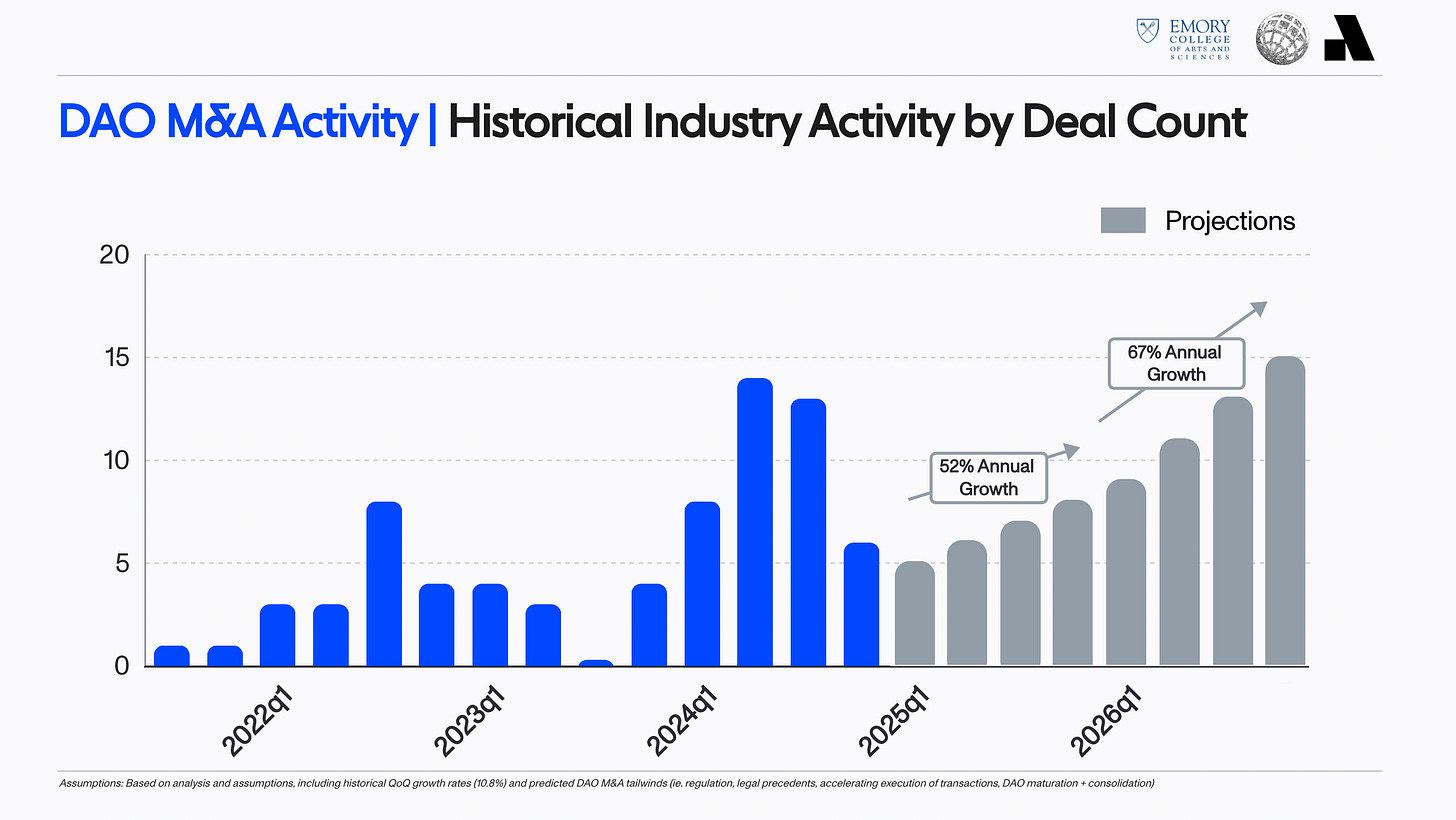

Lastly, the figure below presents a projection model for DAO M&A growth based on standard projection models in investment banking. The model makes a few key assumptions about growth rates: in 2025, we project a quarter-over-quarter (QoQ) growth rate of 11%, leading to an annualised rate of 52%. These assumptions are informed by the historical data where DAO M&A deals have exhibited an average QoQ growth rate of 10.82% over the past three years. For 2026, we expect growth rates to increase to 12.5% in the first half and 15% in the second half, resulting in an annualised rate of 67%. We anticipate acceleration in 2026 due to several factors: a more favourable regulatory environment and legal precedents, an increasing frequency of successful DAO M&A transactions that build industry expertise, and the broader maturation of DAOs, which is expected to drive consolidation and transaction volume.

Case Study 1: Fei and Rari

Background

Fei Protocol, known for its algorithmic stablecoin FEI, merged with Rari Capital to integrate Rari's permissionless lending pools, aiming to enhance liquidity and stability in DeFi. After a swift proposal process led by Fei’s Joey Santoro and Rari’s Jai Bhavnani, both communities approved the merger in December 2021 with over 90% support. The merger formed Tribe DAO, governed by the TRIBE token. However, an $80 million hack in mid-2022, coupled with governance disputes over user reimbursements, led to Fei Labs shutting down Tribe DAO in August 2022, illustrating the complexities of DAO integrations.

Timeline

The merger process and timeline began with Rari Capital suffering an $11 million hack on May 8, 2021, which raised financial concerns about its long-term viability.

On November 16, 2021, Rari founder Jai Bhavnani proposed the merger in FIP-51: Fei <> Rari Token Merge, citing strategic synergies.

By December 2, 2021, Fei DAO and Rari DAO initiated separate votes on Snapshot and Tally, ultimately approving the merger with over 90% community support.

On December 23, 2021, the merger was executed onchain, incorporating a token swap (1 RGT = ~26.7 TRIBE - the native token of the merged projects) and Fei assuming Rari’s financial liabilities.

On January 19, 2022, Fei DAO finalised the merger with FIP-68, confirming governance integration.

However, on April 30, 2022, Rari’s Fuse pools suffered an $80 million exploit, severely impacting financial stability.

By August 24, 2022, Fei Labs announced the winding down of Fei Protocol, citing governance struggles, legal risks, and the inability to cover post-merger losses.

Successes

The Fei-Rari merger marked the first DAO-to-DAO M&A, demonstrating the power of smart contracts for complex transactions without traditional legal frameworks. The merger’s governance-driven process encouraged active community engagement. The theoretical synergies between Fei’s stablecoin and Rari’s lending protocols presented significant potential. Notably, the merger introduced a "ragequit" option, inspired by MolochDAO, allowing dissenting TRIBE holders to exit at fair value, reducing opposition and promoting alignment.

Challenges

Governance misalignment was a major issue, with Fei’s VC-backed leadership clashing with Rari’s community-driven approach. Financial strain arose as Fei absorbed Rari’s liabilities, frustrating TRIBE holders. The fixed RGT-to-TRIBE exchange rate faced criticism from both sides, causing further tension. Security vulnerabilities culminated in an $80 million hack, and disagreements over reimbursements led to severe backlash. Ultimately, Fei Labs’ decision to shut down Tribe DAO left TRIBE holders with significant losses.

Recommendations for Future DAO Mergers

Future DAO mergers should include thorough due diligence to assess liabilities and security risks. Establishing governance alignment strategies is critical to prevent conflicts. Transparent fee structures from service providers can reduce disputes. Comprehensive post-merger integration planning is necessary to ensure operational sustainability. Additionally, implementing robust security measures and financial safeguards can mitigate catastrophic losses. The Fei-Rari merger serves as both a milestone and a cautionary tale for DeFi’s growth.

Case Study 2: Gnosis and xDAI

Background

The Gnosis-xDAI merger in late 2021 brought together two Ethereum ecosystem projects with distinct strengths. xDAI, a stable and low-cost Ethereum sidechain governed by STAKE holders, merged with Gnosis, known for its governance tools, prediction market platform, and substantial treasury. The merger aimed to enhance decentralisation, sustainability, and security by transitioning xDAI from Proof-of-Authority (PoA) to Proof-of-Stake (PoS) using Gnosis’s resources. Post-merge, the network was rebranded as Gnosis Chain, boasting over 100,000 validators. However, the xDAI community voiced concerns over governance shifts, tokenomics, and fears of a Gnosis-dominated structure.

Timeline

November 8, 2021 – Gnosis proposes GIP-16, outlining the merger and the rebranding of xDAI as Gnosis Chain.

November 15, 2021 – A community AMA is held to address concerns, but tensions remain high.

December 8, 2021 – Gnosis Beacon Chain launches, setting the stage for the shift to a fully PoS-based network.

December 8, 2022 – The merger is finalised, officially dissolving xDAI’s governance model and incorporating it under Gnosis’s framework.

Merger Terms

The merger established several key structural changes:

Token Swap – xDAI’s governance token, STAKE, was converted into Gnosis’ governance token GNO at a fixed rate of 0.032629 GNO per STAKE, a decision that was widely debated among community members who believed STAKE was undervalued.

Treasury Allocation – Gnosis committed 400,000 GNO tokens (worth about $190 million at the time) to fund ecosystem development and liquidity incentives, aiming to incentivise builders and expand network adoption.

Consensus Mechanism Shift – xDAI’s previous Proof-of-Authority (PoA) model was phased out in favour of Gnosis’s Proof-of-Stake (PoS), expanding validator participation from 20 to over 100,000 nodes.

While Gnosis presented these changes as necessary for long-term sustainability, many in the xDAI community argued that they had little input in the decision-making process, leading to concerns over governance and centralisation.

Successes

The merger successfully established Gnosis Chain as a scalable, decentralised Layer 2 network. PoS implementation increased security and validator participation, making Gnosis Chain one of the most decentralised Ethereum-compatible networks. Additionally, the $190 million ecosystem fund attracted developers and expanded use cases, strengthening the chain’s position in the Ethereum landscape.

Challenges

Governance and communication missteps marred the merger’s execution. The fixed STAKE-to-GNO swap rate caused frustration among STAKE holders, who felt undervalued. Limited community consultation exacerbated concerns of centralisation, with some labelling the move a “hostile takeover.” The merger also underscored the difficulty of balancing efficient decision-making with decentralised governance, as most decisions were driven by core teams rather than the broader community.

Recommendations for Future DAO Mergers

Future DAO mergers should prioritise fair token valuations using market-driven models to ensure community trust. Inclusive, transparent decision-making is essential to prevent backlash, emphasising meaningful consultation rather than top-down proposals. Structured integration plans should address governance transitions, development funding, and validator coordination to ensure smoother adoption. While the Gnosis-xDAI merger succeeded in its technical goals, its governance challenges serve as a reminder that sustainable DAO mergers require balancing efficiency, transparency, and community alignment.

Valuation Methodologies

The application of traditional valuation methodologies to DAOs reveals significant challenges across all three primary approaches: discounted cash flow (DCF) analysis, comparable company analysis based on multiples, and market-based valuation.

Discounted Cash Flow (DCF) models face unique challenges when applied to blockchain-based organisations like DAOs.

Unlike traditional corporations with stable, contracted human capital, DAOs operate with fluid contributor participation. While onchain transparency provides visibility into activities and compensation, the absence of formal employment agreements complicates the valuation of human capital.

Blockchain platforms introduce complex network effects due to their composability and interoperability. Value can emerge not only from direct platform usage but also from the broader ecosystem of applications interacting with the protocol. While these connections may amplify network value, they also increase fragility, as disruptions in one part of the ecosystem can ripple across interconnected protocols.

Estimating future cash flows and appropriate discount rates in DAOs remains inherently difficult. While blockchain technology offers immutable records for precise revenue tracking, forecasting future performance is fraught with uncertainty due to rapid technological evolution and regulatory risks.

Additionally, determining the Weighted Average Cost of Capital (WACC) is challenging in the volatile crypto market. Stablecoin financing might offer a temporary benchmark, but crypto-financed ventures often experience significant fluctuations in governance token values. Efforts to calculate a "crypto cost of capital" using implied volatility or alternative approaches are typically applied in an ad-hoc manner due to the lack of established industry standards. As a result, DAO valuations can shift dramatically even within the short timeframes of M&A deal closures, complicating accurate valuation using traditional financial models.

A second common approach to valuation is the comparable company analysis approach, but this approach also faces even greater obstacles. Most DAOs reject traditional corporate structures and reporting standards, making it difficult to calculate consistent profitability metrics across protocols. The heterogeneity in token designs and governance structures further reduces the relevance of traditional multiple-based approaches. While some protocols like Uniswap or Aave generate fee income analogous to traditional businesses, others create value through mechanisms that have no clear traditional analogs and thereby, no reasonable set of comparables.

This leaves market-based valuation as potentially the most practical approach, though not without its own complications. The limited number of completed M&A transactions involving DAOs provides few reliable comparison points. While the fully liquid nature of governance tokens provides continuous price discovery, these tokens often trade at significant premiums or discounts to their fundamental value due to control rights and speculation. The market's difficulty in pricing these governance rights is evident in episodes like the Gnosis-xDAI merger, where token holder opposition centred not on financial terms but on concerns about protocol autonomy. These governance premiums vary widely across protocols and time, making it difficult to establish reliable benchmarks for valuation purposes.

Challenges

Valuation

DAOs face challenges in applying traditional valuation methodologies. Key concerns include uncertainty over what is being acquired (e.g., the team, product, or treasury), the impact on token values, and retaining contributors. Acquihires become difficult as contributors are bound by incentives rather than contracts. Token-based deals also risk front-running or governance manipulation. Regulatory uncertainty and the tension between transparency and privacy further complicate valuation.

Legal & Structural Feasibility

DAOs often lack legal personhood, raising difficulties in transferring assets and executing contracts. Legal entities like foundations may be necessary for asset management. Token-based deal structures, including token swaps or partial integrations, add further complexity. Mergers typically require trust in core teams, as legal enforcement mechanisms are unclear.

Governance and Decision-Making

Decentralised governance adds complexity to M&A approval. Unlike corporate boards, token holders vote in public forums, creating transparency but also increasing the risk of delays, contentious votes, and whale influence. Diverging priorities between stakeholders, including token holders, core teams, and developers, complicate consensus.

Financial & Strategic Considerations

Post-merger, measuring financial and strategic success remains uncertain. Metrics like combined protocol revenue and cost savings are difficult to predict. Due diligence relies on publicly available onchain data, reducing information asymmetry but not eliminating risks like unforeseen liabilities. Mechanism designs such as “ragequit” are often used for risk management instead of legal contracts.

Next Steps

There are signs that innovation in the space is beginning to address some of the challenges to growth in the DAO M&A sector.

For example, emerging models like SPADAOs, which mirror SPAC structures in traditional finance, offer a potential pathway for DAOs to engage in acquisitions more efficiently while preserving decentralised governance. New smart contract templates for token swaps or treasury migrations, legal templates for DAO-to-DAO agreements, and even platforms that facilitate discovery of M&A opportunities (a sort of marketplace for DAO assets or partnerships) could address many of the challenges, lower the costs, and decrease the uncertainty associated with existing DAO M&As. Interoperable standards like those published by DAOstar could make it easier to coordinate multi-DAO projects and decisions, creating a gradient of options between partnership and merger. New deal structures could make M&A more accessible to large and small DAOs.

Perhaps one of the biggest factors in the sector’s growth will be the cultural normalisation of M&A within DAO communities. For now, M&As are still rare. As the ecosystem builds its muscle memory, eventually executing a merger could become a relatively routine process for well-prepared DAOs. If so, DAO M&As might usher in an era of protocol conglomerates, where clusters of decentralised projects unite to collectively govern a broader ecosystem, leveraging their pooled resources and diverse communities.

Much remains to be discovered. As DAOs continue to refine their operational structures and regulatory clarity improves, M&A will become an increasingly important tool for DAOs to grow, consolidate, and move forward. The coming years will reveal whether DAO M&A moves from a handful of case studies to a common strategy in the toolkit of decentralised governance and how the balance between decentralisation and consolidation is struck in practice.

We’d like to extend our thanks to Joshua Tan (DAOstar) and Jillian Grennan (Emory University) for their collaboration. Find the full State of DAO M&A report here!

If you’re looking to refine your approach to capital allocation, enhance builder participation, or drive sustainable growth in your ecosystem, we’d love to chat!

Feel free to reach out via TG to Bernard or Sid - our DMs are open.

Follow Us 🫶🏽